Do You Need Roadside Assistance Insurance

When your car breaks down, the sinking feeling is palpable. But with roadside assistance insurance, this inconvenience doesn’t have to turn into a crisis. Here’s why every driver should consider securing a safety net that keeps them protected on the go.

Key Takeaways

- Roadside Assistance Insurance: Essential for drivers to ensure support during vehicle breakdowns.

- Coverage Options: Range from basic services like towing and jump-starts to comprehensive plans with additional perks.

- Considerations: Cost, the extent of coverage, and the provider’s reliability should guide your choice.

What is Roadside Assistance Insurance?

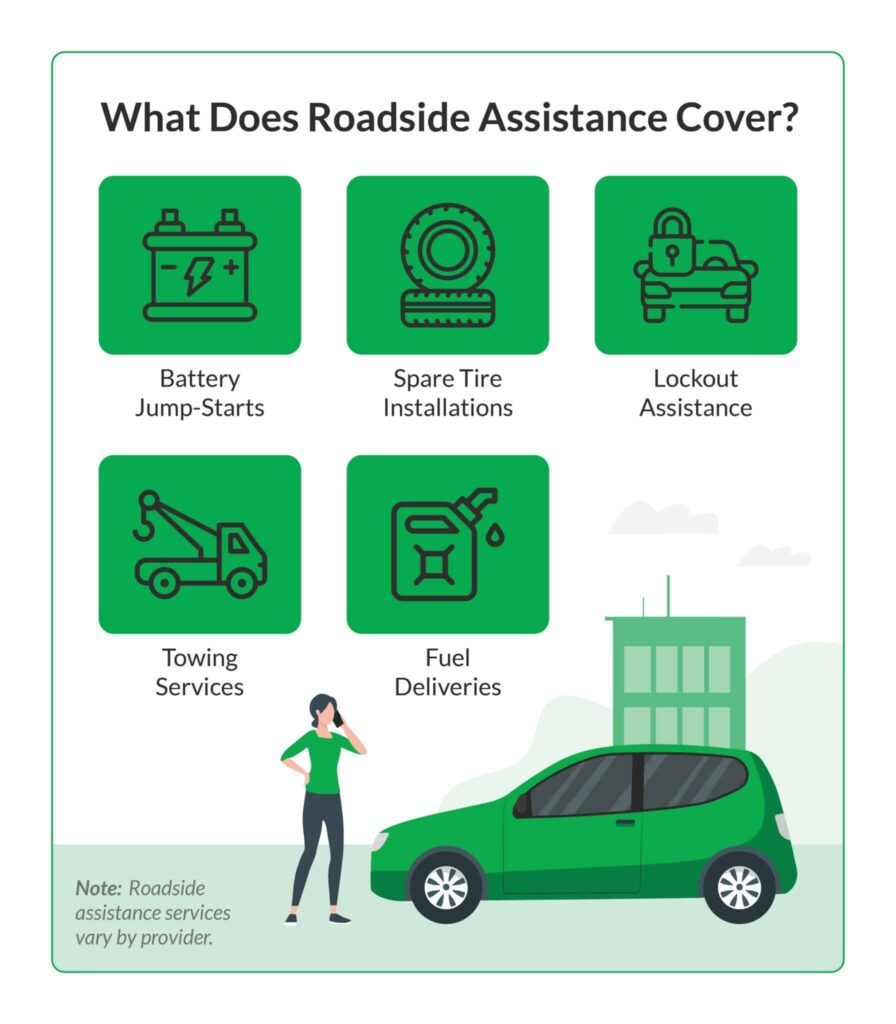

Roadside assistance insurance is more than just a perk; it’s a lifeline. Whether you’re facing a flat tire, a dead battery, or a lockout, roadside assistance can transform a potential day-ruiner into a minor hiccup on your journey. Providers like AAA, Allstate, and GEICO offer various plans that help with towing, jump-starts, and even fuel delivery, ensuring you’re never left stranded (Carinsurance.com) (Insurify).

Deciding on the Right Coverage

Choosing the right roadside assistance plan involves weighing the breadth of services against their cost. Some plans are embedded in your existing car insurance policies, while others come as stand-alone memberships or even benefits through your credit card company. Premiums can vary significantly based on the coverage extent and the provider (The Zebra) (Insurify).

Comprehensive vs. Basic Plans

For those who drive frequently or have older vehicles, a comprehensive plan might be ideal. These plans often cover a wide range of services and can include additional perks like trip interruption coverage and discounts on related services. Conversely, if you rarely drive or own a new car with included coverage, a more basic plan may suffice (Carinsurance.com) (Insurify).

The Cost of Peace of Mind

The cost of roadside assistance can range from as little as $14 per year to over $100, depending on the provider and the services included. While it might seem like an unnecessary expense, the cost of a single tow or roadside repair often exceeds the annual fee of a roadside assistance plan, making it a wise investment for most drivers (Insurify) (NerdWallet).

Choosing a Provider: What to Look For

When selecting a roadside assistance provider, consider not only the cost but also the company’s reputation and the ease of accessing services. Check whether the plan covers only your vehicle or all household members and whether it’s restricted to your own vehicle or extends to any car you might be driving (NerdWallet).

Real-Life Example

Imagine you’re on a road trip and you encounter a flat tire. With a robust roadside assistance plan, a quick call or app request can have help on the way in minutes, turning a potential ordeal into a short pause in your adventure.

Table: Roadside Assistance Coverage Comparison

| Provider | Annual Cost | Towing Distance | Additional Perks |

|---|---|---|---|

| AAA | $65 – $125 | Up to 200 miles | Travel discounts, car rental |

| Allstate | $25 – $179 | Up to 5 miles | Trip interruption up to $1,500 |

| GEICO | $14+ | Nearest facility | Lockout services, fuel delivery |

These are just examples and actual costs and services can vary (Insurify) (GEICO).

Selecting the right roadside assistance provider is crucial for ensuring that you’re covered in case of unexpected vehicular issues. Let’s break down what to consider when choosing a provider and how different services stack up.

What to Consider When Choosing a Provider

Coverage Options

It’s essential to understand what each plan covers. Does it include just the basics like towing and jump-starts, or does it also offer help with flat tires, fuel delivery, and lockout services? Knowing exactly what you’re getting can help you decide if a plan meets your needs.

Cost Effectiveness

While some plans may seem expensive, comparing the cost against the benefits provided can demonstrate value. For instance, a higher-priced plan might offer extensive towing distances and additional perks that could save money in the long run, especially if you frequently travel or have an older car that might be more prone to issues.

Provider Reputation and Reliability

The reliability of a provider is paramount. Look for reviews and ratings from other users to gauge how dependable the service is. How quickly do they respond to calls? Are there any recurring complaints about the service? These are critical questions that need answers before you commit to a plan.

Ease of Use

Consider how you will interact with the service. Is there a user-friendly app? Can you request help online, or do you need to make a phone call? The ease of accessing the service can significantly impact your experience during stressful situations.

Comparing Top Roadside Assistance Providers

Let’s look at some popular options and what makes them stand out:

AAA

AAA is renowned for its comprehensive coverage and additional member benefits like travel discounts and trip-planning services. However, its cost can be higher than some other options.

Allstate

Allstate offers a range of plans, from basic roadside assistance to comprehensive options that include trip interruption benefits. It’s known for its flexibility in service plans and affordability.

GEICO

GEICO’s roadside assistance is praised for its affordability and the inclusion of services like lockout assistance and towing to the nearest repair facility. It’s a solid choice for those who want essential services at a competitive price.

State Farm

State Farm provides a balance of affordability and coverage, making it a good option for those who already have their auto insurance with the company and can benefit from bundling services.

Table: Features of Different Roadside Assistance Plans

| Provider | Cost Range | Key Features | Availability |

|---|---|---|---|

| AAA | $65 – $125 | Extensive towing, travel discounts | Nationwide |

| Allstate | $25 – $179 | Flexible plans, trip interruption benefits | Nationwide |

| GEICO | $14+ | Cost-effective, essential services | Nationwide |

| State Farm | Varies | Good for bundling, reliable service | Nationwide |

These details provide a snapshot of what each provider offers, but it’s always best to visit their websites for the most current information and to confirm the specifics of their plans.

Frequently Asked Questions

What is the difference between roadside assistance included in car insurance vs. a standalone plan?

Roadside assistance included in car insurance often comes at a lower cost but may have limitations on usage to prevent impact on insurance premiums. Standalone plans, such as those from AAA, may offer more comprehensive services and additional benefits but at a higher cost.

Can I use my roadside assistance for someone else’s car?

This depends on the provider. Some services, like those offered through insurance companies, are typically tied to the vehicle, whereas membership-based services like AAA cover the member, regardless of the vehicle they are using.

How often can I use roadside assistance without affecting my car insurance?

This also varies by provider and plan. Using roadside assistance frequently can sometimes impact your insurance rates, especially if the service is tied to your auto insurance. It’s essential to check this with your provider to understand their policy.

By carefully considering these factors and comparing the options available, you can choose the roadside assistance plan that best suits your needs, ensuring you’re never left stranded on the road.